Book Value Per Share BVPS: Definition, Formula, How to Calculate, and Example

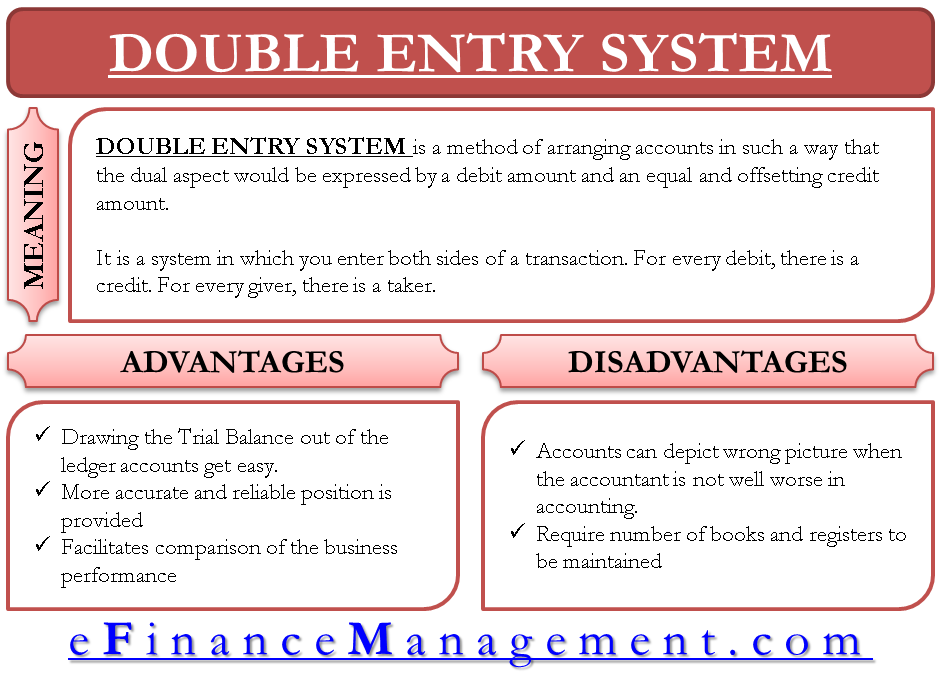

Financial instruments are assets, or packages of capital, that can be traded. The book value per share and the market value per share are some of the tools used to evaluate the value of a company’s stocks. The market value per share represents the current price of a company’s shares, and it is the price that investors are willing to pay for common stocks. The market value is forward-looking and considers a company’s earning ability in future periods. As the company’s expected growth and profitability increase, the market value per share is expected to increase further. The term “Book Value of Equity” refers to a firm’s or company’s common equity, which is the amount available that can be distributed among the shareholders.

So, why waste your time traveling around the city for a reliable dealership or spend hours trying to find seamless services online? Droom, with its sophisticated interface, adopts a pro-active approach to make the whole journey for both buyers/sellers a rewarding one. Likewise, the same concept is applied to the value assigned to the fixed assets recorded on a company’s balance sheet. The accounting concept of depreciation, a non-cash expense added back on the cash flow statement , reduces the fixed asset’s net book value in accordance with its useful life and salvage value assumption.

- Book value, also known as book cost or average cost, represents the average amount you have paid for your investments – which can change over time .

- Book value is not often included in a company’s stock listings or online profile.

- It takes the net value of a listed company’s assets, also known as shareholder’s equity, and divides it by the total number of outstanding shares of that organization.

- Using the XYZ example, assume that the firm repurchases 200,000 shares of stock and that 800,000 shares remain outstanding.

- The book value of equity reflected on a company’s balance sheet is seldom equal to, or even near, the market value of equity.

This set of pertinent information can be used for offline buying/selling, insurance, and auto loan. So, go ahead and get your used car valuation done for your benefit with Orange Book Value. Simply quote the Fair Market Price generated through the OBV tool for the listed car. So, when a potential buyer checks out the car and its price, they can rely on the OBV report which is generated through an algorithmic pricing engine and not by the expectations of a seller or buyer. With regard to the assumptions surrounding the fixed asset, the useful life assumption is 20 years while the salvage value is assumed to be zero.

After 2 years, the company revalued the asset and its revised value at the end of the 2nd year turns out to be 1,40,000. Its remaining useful life was re-estimated at 5 years with nil salvage value. Step 3 – Subtract accumulated depreciation from the historical cost of the asset. Net Book Value represents the carrying value of an asset that is equal to the value after deducting depreciation, depletion, amortization and/or accumulated impairment, to date. It is the value at which an asset is recorded in the balance sheet of an enterprise. A P/B ratio below 1 often indicates that a company’s stocks are undervalued since its market capitalisation is lower than its book value.

The book value of a company is the total worth of all its assets minus all its liabilities. Investors looking for low-priced but fundamentally sound stocks use a company’s book value to see if its shares are fairly priced. Is marked to market, i.e., it captures the most current market value of the assets and liabilities.

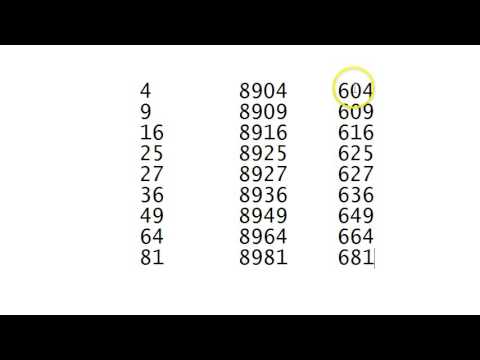

Book Value of Equity Formula

TheNet Book Value describes the carrying value of an asset recorded on a company’s balance sheet for bookkeeping purposes. This is an accelerated depreciation method that expenses more depreciation at the beginning of the life of an asset than at the beginning. This rate is found by multiplying the straight line percentage of depreciation. For example, double-declining depreciation for asset with a 10-year life would be 2 x 10%, or 20%. This means that the new book value at the end of an accounting period would be 20% less than the previous book value.

Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin. To exemplify this method further, the depreciation expense in the second year would be based off of the first year-end book value, which is $10,000-$2,000, or $8,000. The depreciation expense in the second year would be 20% of $8,000, or $1,600, leaving us with a second year-end book value of $6,400 for the asset.

Sales tax

Vivek asks him to compute P/BVPS for SBI and then compare peer-to-peer. For the initial outlay of an investment, book value may be net or gross of expenses such as trading costs, sales taxes, service charges, and so on. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses.

StockholdersA stockholder is a person, company, or institution who owns one or more shares of a company. They are the company’s owners, but their liability is limited to the value of their shares. Also, we can add Equity Share capital and Reserves to get shareholder’s equity which is 5,922 cr + 2,87,569 cr, which will sum to 2,93,491 cr. Written-down value is the value of an asset after accounting for depreciation or amortization.

A company’s market value will usually be greater than its book value since the market price incorporates intangible assets such as intellectual property, human capital, and future growth prospects. Value investors look for companies with relatively low book values (using metrics like P/B ratio or BVPS) but otherwise strong fundamentals as potentially underpriced stocks in which to invest. In theory, BVPS is the sum that shareholders would receive in the event that the firm was liquidated, all of the tangible assets were sold and all of the liabilities were paid. However, its value lies in the fact that investors use it to gauge whether a stock price is undervalued by comparing it to the firm’s market value per share.

It is the profit a company gets when it issues the stock for the first time in the open market. The price-to-book value ratio, also known as the price-equity ratio, is also derived from the book value of an organisation. P/B ratio shows the relationship between a company’s market capitalisation and its book value. In personal finance, the book value of an investment is the price paid for a security or debt investment. When a company sells stock, the selling price minus the book value is the capital gain or lossfrom the investment. Also known as the price-equity ratio, is also derived from the book value of an organization.

How to Calculate Book Value.

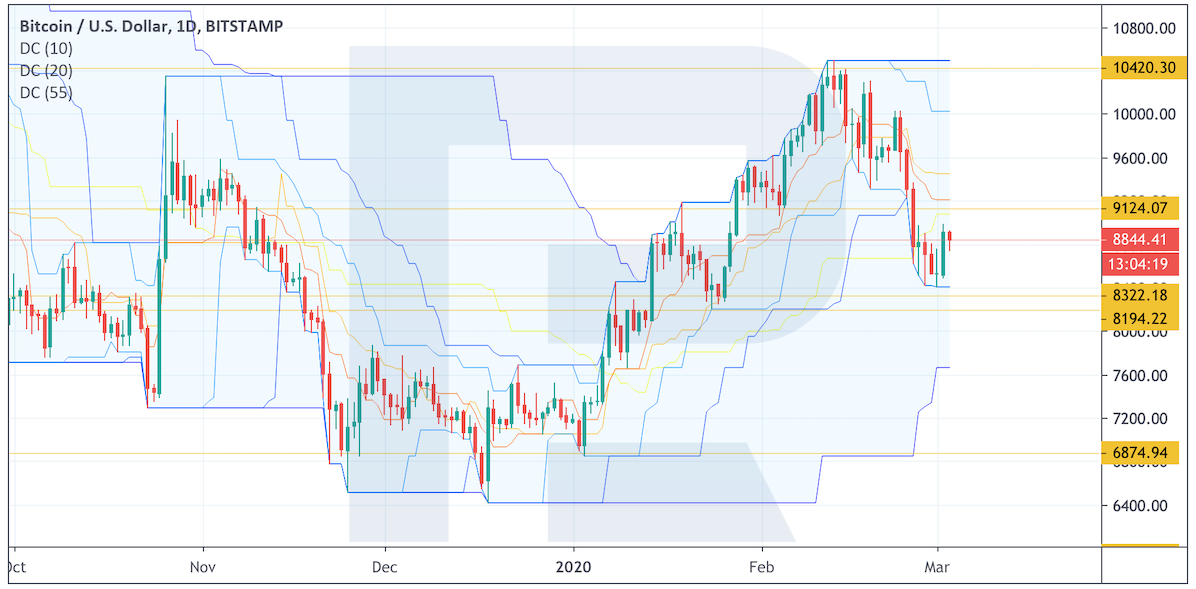

Price-to-book (P/B) ratio as a valuation multiple is useful for value comparison between similar companies within the same industry when they follow a uniform accounting method for asset valuation. It provides services in the area of investment banking, commercial banking, and treasury services, among others. However, during the stock market crash of March 2020, the stock price declined by around 40%. You will need the number of shares outstanding obtained from the income statement. Also, you can use our handy market cap calculator to obtain the value.

How Do You Calculate Book Value of Assets?

If a company’s BVPS is higher than its market value per share, which is its current stock price, then the stock is considered undervalued. Another way to increase BVPS is to repurchase common stock from shareholders. Using the XYZ example, assume that the firm repurchases 200,000 shares of stock and that 800,000 shares remain outstanding. Besides stock repurchases, a company can also increase BVPS by taking steps to increase the asset balance and reduce liabilities. The book value per share is calculated by taking the ratio of equity available to common stockholders against the number of shares outstanding. When compared to the current market value per share, the book value per share can provide information on how a company’s stock is valued.

What is growth investing? A strategy that focuses on high-growth companies in hopes for significant investment returns

Intangible assets and liabilities are deducted from the total asset amount to calculate the book value of the asset. One example of an intangible assets is intellectual property, like music, digital artwork, etc. Liabilities are the outstanding obligations that a company has to pay back within a limited period of time. When calculating the book value per share of a company, we base the calculation on the common stockholders’ equity, and the preferred stock should be excluded from the value of equity.

It helps in estimating the real value of the assets which also helps in business valuation at the time of liquidation of the company. Example 1 – Suppose a company purchases a pre-owned truck worth 80,000 & further, incurs a cost of 10,000 for its repairs before using it. Also, it decides to charge depreciation @ 10% as per the straight-line method. The book value shown on the balance sheet is the book value for all assets in that specific category. Book value does not need to be calculated for more stable assets that aren’t subject to depreciation, such as cash and land. Depreciable assetshave lasting value, and they include items such as furniture, equipment, buildings, and otherpersonal property.

Based on that, they can gauge whether stock prices will go down or up in the future. DividendDividends refer to the portion of business earnings paid to the shareholders as gratitude how to calculate book value for investing in the company’s equity. It serves as the total value of the company’s assets that shareholders would theoretically receive if a company was liquidated.

The selection of method depends on the nature of the asset.The straight-line is most commonly used by accountants to keep depreciation expense simple and constant throughout the asset’s life. Salvage value is a measure of the remaining value of an asset after that asset has reached the end of its useful life. The asset may be either sold or scrapped to achieve the salvage value.